Borrow Up to 95% CMHC’s MLI Select Mortgage Program

Good For Your Canadian Real Estate Investment?

Access to capital has become more challenging with rising interest rates, prompting Canadian real estate investors to explore innovative financing solutions.

A topic of increasing interest among them is the CMHC MLI Select mortgage, which offers appealing benefits for Canadian investors with limited funds.

The MLI Select program allows investors to finance up to 95% of a property’s value, provided the investment is in a multiplex with five or more units.

This option also features reduced interest rates and extended repayment terms. With Canada’s regulations permitting the conversion of any house into a fourplex plus an additional backyard dwelling, this financing solution is garnering significant attention from the local investment community.

The CMHC MLI Select mortgage may be an advantageous choice for some Canadian real estate investors, but is it the right one for you? Let’s explore further!

What Is the CMHC Mult-unit MLI Select Mortgage?

The CMHC MLI Select mortgage is a financing solution specifically designed for investors looking to purchase multiplexes with five or more units. This program evaluates applicants based on affordability, energy efficiency, and accessibility features of the property.

Investors can secure up to a 95% loan-to-value ratio, enjoy repayment periods of up to 50 years, and benefit from limited recourse under a commercial mortgage framework. The program awards points for meeting various criteria, and the total points achieved can influence the mortgage terms an investor qualifies for. Here’s a closer look at the specifics of the CMHC MLI Select Program.

However, there are some considerations to be aware of regarding how the MLI Select operates in practice.

Lengthy Approval Process

The approval process for the MLI Select can extend to about six months, with an additional two months needed for design and drawings. Although it’s possible to overlap the design phase with the closing period, this does not expedite the MLI application itself.

Consequently, investors often need to secure a conventional residential mortgage and meet the typical 20% down payment requirement, in addition to covering renovation expenses during the MLI Select application phase.

Moreover, CMHC may be tightening refinancing regulations, potentially requiring a 24-month waiting period before refinancing is permitted.

Significant Initial Capital Required

Contrary to some expectations, the MLI Select demands a substantial initial investment. The most cost-effective strategy usually involves upgrading an existing property rather than constructing a new one.

For a project that includes converting a building into a 4-unit property and adding a backyard dwelling, the upfront cash requirement could exceed $900,000, taking into account the down payment and closing costs. Achieving success in such projects demands time and expertise.

Challenges in Achieving 95%

LTV Attaining the 95% loan-to-value ratio may be more difficult than anticipated due to stringent rent-to-income ratio requirements. To illustrate, consider an example project where an investor purchases and renovates a property to create multiple units. While a conventional refinancing approach might allow nearly all initial capital to be recouped, an MLI Select project—due to its scale and the rent ratio caps—could necessitate a significantly higher financial and time investment, along with more complex development challenges, even though it potentially allows for borrowing slightly above the total project cost.

When Is the CMHC MLI Select a Smart Choice?

The CMHC MLI Select mortgage emerges as a powerful tool for those aiming to significantly expand their Canadian real estate portfolio. This program diverges from traditional residential mortgages, which are generally limited by the borrower’s personal financial capacity and can become restrictive with the accumulation of more properties and debt. In contrast, the MLI Select, being a commercial mortgage, bases qualification solely on the cash flow performance of the property in question, effectively removing the barrier of how many properties one already owns.

Qualification for this mortgage doesn’t hinge on the number of properties in your portfolio but rather on the cash flow generated by the property you’re investing in. This aspect is particularly advantageous for expanding your investment portfolio without the constraints typical of personal borrowing limits. Additionally, the MLI Select provides limited recourse, offering enhanced protection compared to residential mortgages in the event of default.

Large-scale projects financed through the MLI Select typically yield higher rents due to the creation of more units, leading to improved cash flows and potentially significant increases in property value. This setup not only allows for more substantial income generation but also reduces risk post-construction, making it an attractive option for those looking to grow their real estate investments in Canada aggressively.

When Is Sticking to a Residential Mortgage Preferable?

If maximizing the return on your limited funds and time is your priority, opting for a smaller project with a residential mortgage might be the more prudent choice. Residential mortgages are typically extended based on the market value of the property, and with potential for appreciation in the coming year, you might find more favorable loan-to-value ratios with a residential mortgage in 2024.

The Canadian real estate landscape is currently experiencing rapid changes in housing policy, which can be advantageous for those interested in developing more units. Coupled with a slight decrease in interest rates, this scenario is set to enhance affordability and potentially lead to an increase in real estate prices.

Furthermore, the persistent gap between the high demand for homes and the limited supply is expected to sustain strong prices and rental income. Although large-scale projects may seem appealing, smaller-scale endeavors often present a more accessible opportunity, characterized by lower investment requirements, reduced construction risks, and solid returns.

Currently, the market is leaning in favor of buyers, suggesting the possibility of securing advantageous deals. However, it’s important to note that fixed interest rates have been decreasing rapidly, with a significant drop of over 1% in just a few weeks. Financial institutions are also adjusting their interest rate forecasts downward, indicating that this buyer-friendly market may not last as long as previously anticipated.

How We Can Assist You

If you’re poised to navigate the most promising opportunities in the current market, we’re here to support you.

Our approach sets us apart from the conventional real estate sales brokerage. We prioritize data-driven decision-making in Canada’s real estate landscape. This includes identifying investments that yield positive cash flow, strategizing on risk mitigation, and uncovering avenues to enhance returns, such as through value-add renovations and investing in gentrifying neighborhoods.

Should you wish to explore your real estate aspirations in a more personalized setting, we invite you to schedule a consultation with us. Simply click the button below to book your call!

Discover the Benefits of MLI Select

CMHC’s MLI Select offers tailored mortgage insurance solutions that empower you to confidently purchase your investment property sooner and with less money down.

• Lower Premiums: Enjoy competitive rates that make homeownership more affordable.

• Flexible Coverage: Tailored insurance options to meet your unique needs.

• Peace of Mind: Secure your investment with Canada’s trusted mortgage insurance.

How MLI Select Works

1. Eligibility Check: Confirm your eligibility with simple, straightforward criteria.

2. Application Process: Apply through your lender, providing the necessary documentation.

3. Approval & Coverage: Receive fast approval and immediate coverage, ensuring your path to homeownership is smooth and secure.

How many points can you achieve with MLI Select?

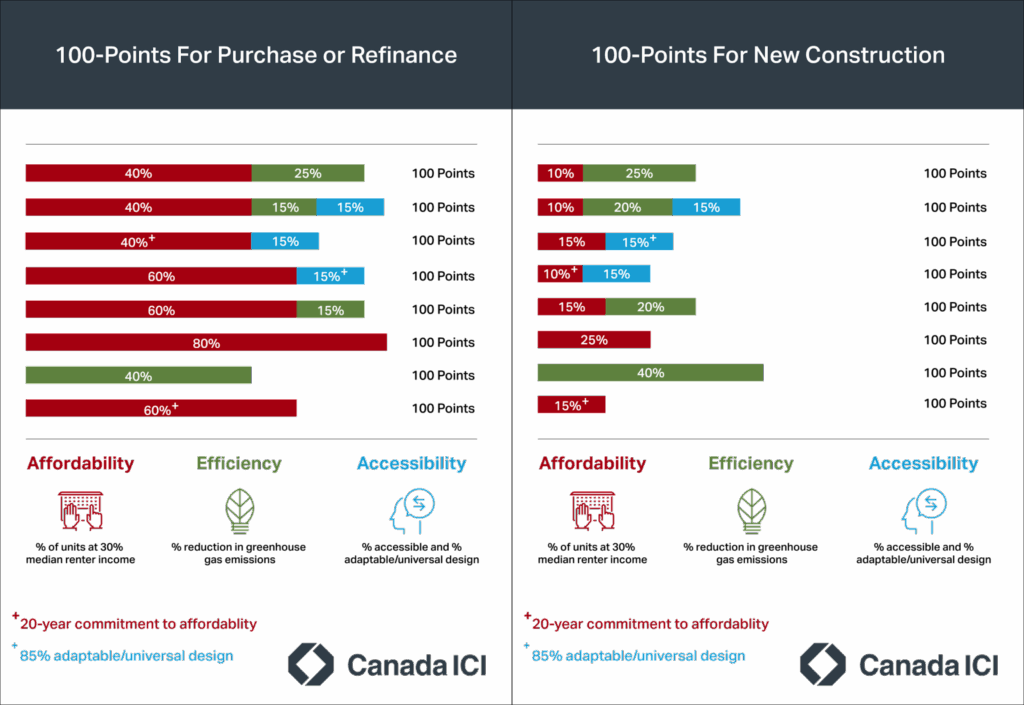

The emphasis of your project on energy efficiency, affordability, and accessibility directly impacts your benefits under this program. The more your project aligns with these criteria, the higher your score will be, leading to more favorable loan insurance conditions. To be eligible, projects need to achieve a minimum score of 50 points. Achieving 100 points unlocks the most advantageous terms. However, it’s important to note that scoring above 100 points does not provide additional benefits beyond this threshold.

A flexible feature of the program is its adaptability to various project focuses. The points system allows for multiple strategies, whether you’re concentrating solely on energy efficiency or integrating all three key areas.

For instance, in new construction projects, achieving a 100-point score is possible through different means. You could attain this by making your building 40% more energy-efficient and reducing greenhouse gas emissions beyond the 2017 benchmarks. Alternatively, a combination approach could also yield 100 points by achieving a 25% improvement in current performance coupled with designating 10% of your units as affordable rentals.

Ready to Build Your Canadian Portfolio?

The best opportunities don’t last. Let our expertise guide you to the right properties faster. Start the conversation today.